These official pronouncements are the detailed rules or standards for specific topics. 2 List of 10 Basic Accounting Principles 2.1 Historical Cost Principle 2.2 Revenue Recognition Principle 2.3 Matching Principle 2.4 Full Disclosure Principle 2.5 Cost Benefit Principle 2.6 Conservatism Principle 2.7 Objectivity Principle 2.8 Consistency Principle 3 List of Key Accounting Assumptions 3. When accounting is overlooked or ignored, most business owners tend to end up paying for their mistakes, especially when tax season is right around the corner.

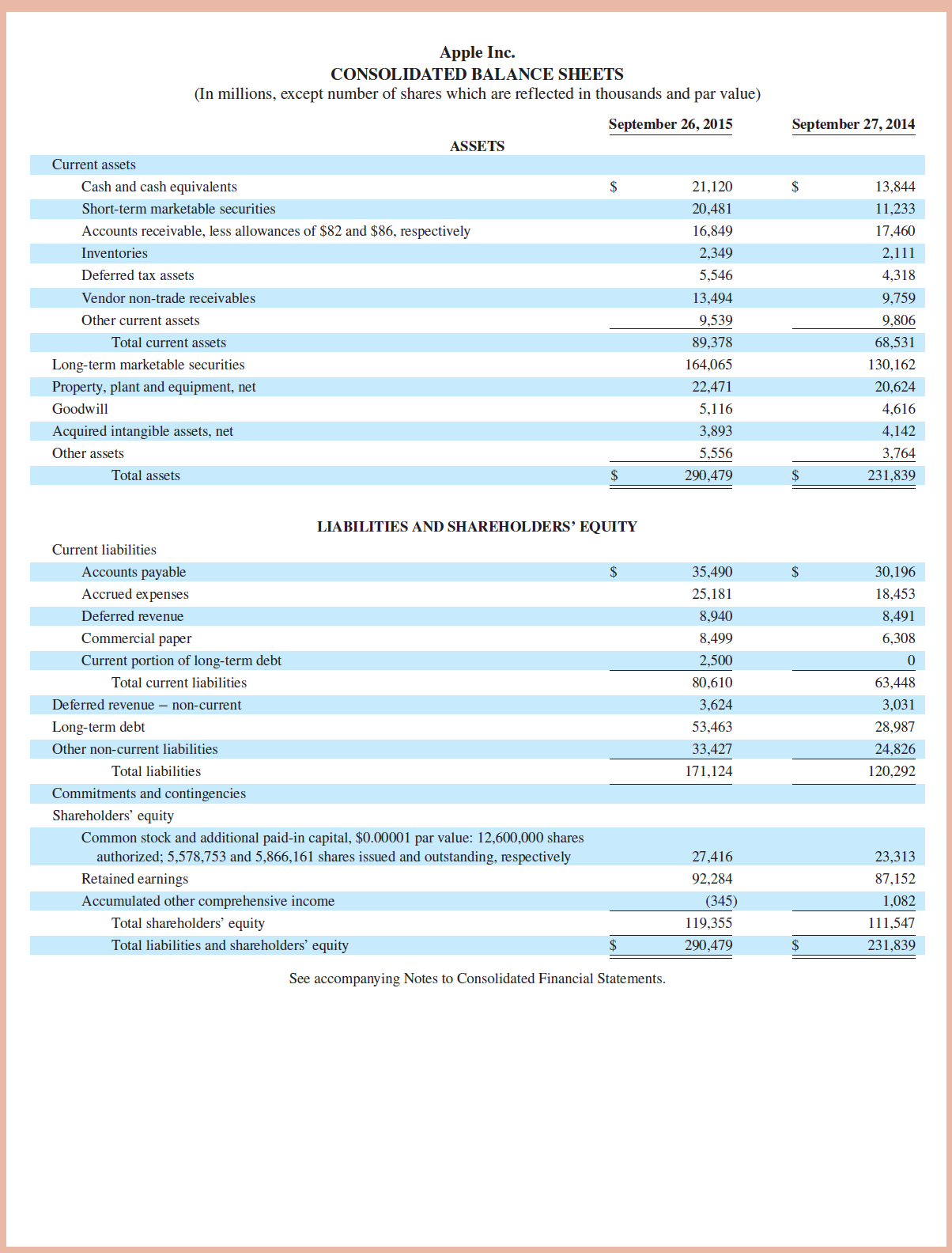

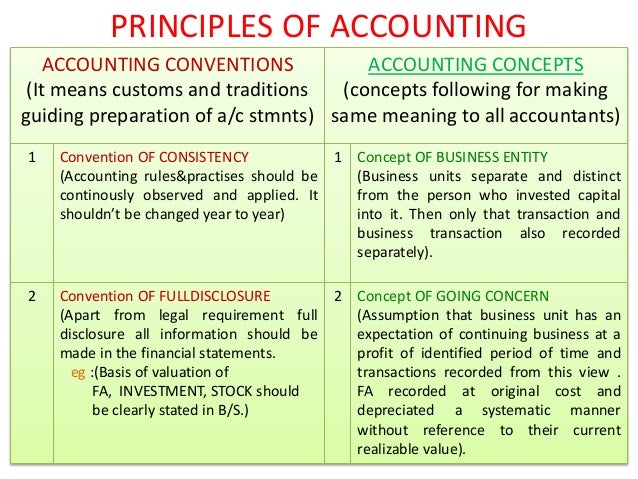

There are two main accounting methods that you can use: accrual basis and cash. In this context, principles of accounting includes both the underlying basic accounting principles and the official accounting pronouncements issued by the Financial Accounting Standards Board (FASB). Financial statement: A financial statement is a document that reveals the financial transactions of a business or a person. Here are the nine most important accounting concepts small-business owners should know. Principles of accounting can also mean generally accepted accounting principles (GAAP).In this context, principles of accounting refers to the broad underlying concepts which guide accountants when preparing financial statements. Concepts Statements guide the Board in developing sound accounting principles and provide the Board and its constituents with an understanding of the. In the United States, the Generally Accepted Accounting Principle, also known as GAAP, is an accounting standard that must be followed while presenting and preparing financial statements. Principles of accounting can also refer to the basic or fundamental principles of accounting: cost principle, matching principle, full disclosure principle, revenue recognition principle, going concern assumption, economic entity assumption, and so on. Accounting standard refers to the set of rules, guidelines, and principles framed by the regulatory body or the government that act as a framework for accounting policies and practices. Why It Matters 1.1 Explain the Importance of Accounting and Distinguish between Financial and Managerial Accounting 1.2 Identify Users of Accounting Information and How They Apply Information 1.3 Describe Typical Accounting Activities and the Role Accountants Play in Identifying, Recording, and Reporting Financial Activities 1.It was also common for the textbook used in the course to be entitled Principles of Accounting. Principles of accounting was often the title of the introductory course in accounting.Three meanings come to mind when you ask about principles of accounting.

0 kommentar(er)

0 kommentar(er)